There are many benefits of Real Estate Syndication, but before knowing them, let us have a brief knowledge of real estate syndication, and syndicators. It’s usually advised to include a variety of properties in your real estate investing portfolio in order to make money. If all of your real estate holdings are single-family houses, you might want to think about investing in an apartment complex or commercial property. The drawback is that these properties are pricey and frequently necessitate a very high level of managerial competence. Don’t let that stop you, though. You can think about taking part in real estate syndication if you wish to invest in bigger, better properties but lack the funds or knowledge to do so.

This essay will discuss what real estate syndication is, why real estate investors might want to pursue one, and how to make money from one. Real estate investors can take a step toward generating profitable investments and completing their real estate portfolio with the help of Fortune Builders’ thorough and useful guide for understanding real estate syndication.

Responsibilities of Real Estate Syndicator

As the syndicator, you will bear a lot of responsibilities. The investors play a largely passive role; once all the money has been invested, they will step aside and leave you in charge of all other matters. You’ll need to keep them updated on the status of the investment on a frequent basis.

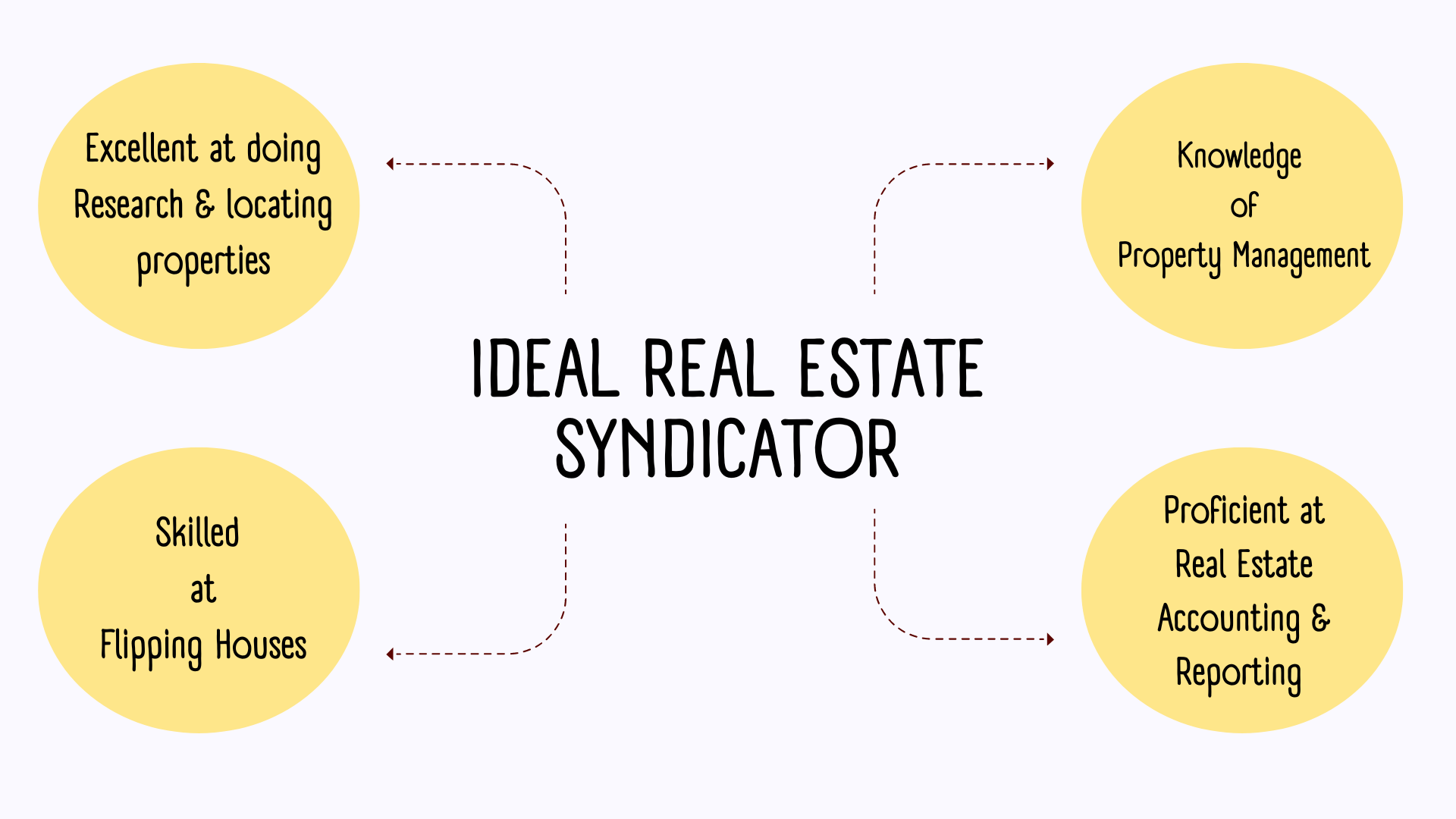

Before knowing Benefits of Real Estate Syndications, the real estate syndicator position can be ideal for you if:

- You’re excellent at doing research and locating suitable properties.

- You have knowledge of property management

- You are skilled at flipping houses.

- You are proficient in real estate accounting and reporting.

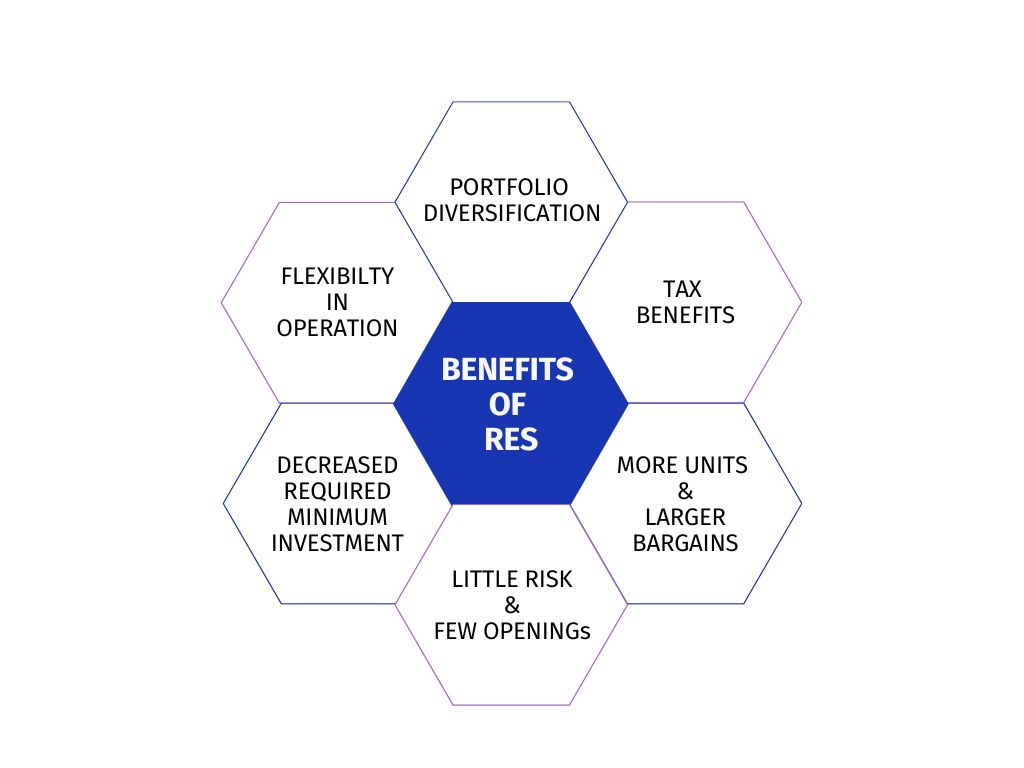

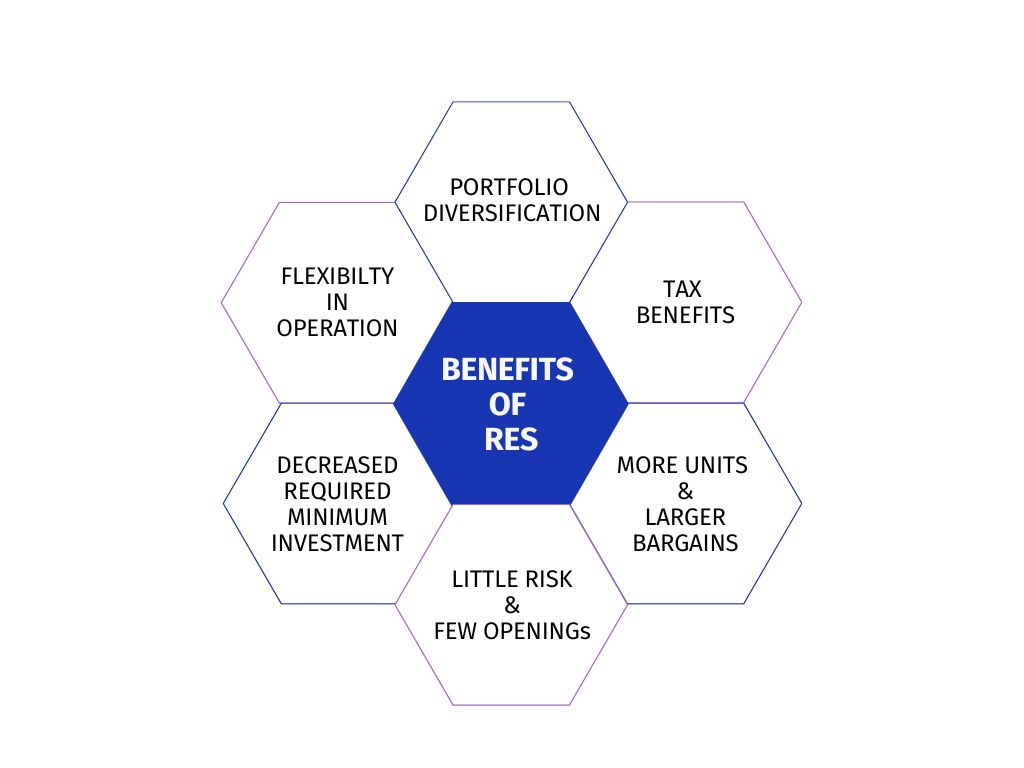

Best Benefits of Real Estate Syndication.

Your real estate portfolio will be more diversified, more liquid, and will produce consistent cash flow if you use real estate syndication. Additionally, it is a cheap way to invest your money. Here are the top six benefits of real estate syndication investing:

-

Portfolio Diversification- An important amongst benefits of real estate syndication

In the benefits of Real Estate Syndication there includes intricate legal contracts involving several partners that call for legal and financial knowledge. Syndication operates as follows: an investor purchases a property, divides the equity with a number of other investors, and then sells it to the following buyer. The process is managed by an agent, broker, or real estate syndication software.

This cycle keeps going until the house is sold. Your real estate portfolio is diversified, made more liquid, and produces consistent income flow through real estate syndication. Additionally, it is a cheap way to invest your money. To start, you don’t require a sizable sum of money. Second, you only need two investors to syndicate. The management cost is typically modest or perhaps nonexistent.

-

Tax Benefits:

Companies that specialize in RES, can be a great option for tax-advantaged investors who want to profit from the expanding real estate market. The returns on real estate syndication investments are expressed as annual percentage rates (APRs). This tax saving benefits of Real Estate Syndication should be known.

Additionally, while interest and dividend income are taxed as ordinary income, capital gains distributions are often tax-free. Additionally, the tax rate on capital gains is less than the tax rate on income. Many people make the following deductions:

Mortgage Interest Property Tax Operating Expenses & Repairs Depreciation (Accelerated).

-

More units and larger bargains

You can take part in bigger deals, which often gain more publicity, give more opportunity for networking and professional progress, and possibly have better upside, if you have greater access to finance. They might also make your portfolio look better. One must be mindful of benefits of real estate syndication, in order to gain larger bargains.

-

Amongst all Benefits of Real Estate Syndication- It little risk and few openings.

One of the best upsides for lowering risk is the multifamily syndication. As an investor, there are two main factors that help reduce risk. Working with more significant properties is the first. There are more tenants in these buildings. If there are any issues with one or two tenants in a larger property, it will have a much smaller impact on the bottom line than if it were a duplex or other similar investment. The second risk-reducing element is the collective sharing of losses.

Any losses are shared equally by the entire syndicate. Rent collection problems or unforeseen financial obligations are examples of burdens. You won’t have to deal with these on your own if you join a real estate syndicate.

Consider that you own a four-unit townhouse. 25% of your revenue will be lost if you are unable to rent out one of them. The vacancy rate drops to 2% in the same scenario for a 50-unit building. Every commercial real estate transaction carries the risk of a vacancy, so it is generally preferable to work with the most expensive property you can find.

-

Decreased Required Minimum Investment

Some private real estate funds demand a large minimum cash down payment from investors. If you require $5 million to invest in a private real estate fund, you might be out of money. Less money is typically required as a minimum investment in real estate syndications. Amongst all the benefits of Real Estate Syndications, this is a cost-effective strategy to have a significant impact on the real estate market.

Real estate syndication allows for small investments and is simpler to administer. Since real estate earnings are typically consistent, syndication may be a great long-term investment.

For instance, a real estate investment typically requires a minimum investment of some thousand dollars. For investors who wish to engage in real estate but don’t have a lot of cash on hand, it lowers the entry barrier. With a smaller investment of some thousand dollars you can achieve the same results. It enables you to invest in real estate while diversifying your overall financial portfolio.

-

Flexibility in operation- to enjoy benefits of Real Estate Syndications investments

Self-dealing practices are used by some private real estate funds, allowing them to prioritize their own interests over those of their shareholders. Syndications in the real estate industry are obligated to act in the shareholders’ best interests. By doing this, you can make sure that your benefits of real estate syndication investment is maximized.

It’s a special approach to get good returns on your investment. Second, you can diversify your assets through real estate syndication to avoid being overexposed to any one investment.

Building enduring relationships with other investors through real estate syndication gives you the chance to seize lucrative investment opportunities in the future.

Regarding the first point, real estate syndication investing enables you to reap high yields while maintaining a stake in the underlying asset.

You can spread out your assets across a wide number of properties by investing in real estate syndication. By doing this, you increase your chances of seeing profits across the whole real estate cycle.

It can result in connections with other investors, which may eventually lead to profitable investment opportunities.

Conclusion:

After knowing benefits of Real Estate Syndication, one must make mind to invest in it soon. A excellent approach to invest your money is in a private fund or real estate syndication. Real estate investment development potential is combined with the security and consistency of stocks and bonds in these kinds of investments. They also provide defense against price increases and market turbulence.

You may meet your long-term financial needs with either kind of real estate investment, and your money will increase and remain stable over time. The decision ultimately hinges on a number of variables, such as your personal financial circumstances, your financial ambitions, and your present tax situation.