Let us know in deep about Real Estate Syndication

-

Real Estate Syndication: What is it?

Before there was ever real estate crowdfunding, there was real estate syndication, or “crowdfunding for real estate”. Both syndication and crowdfunding, in its most basic forms, require combining financial resources. The purchase of a real property, or a tangible building you can see and touch, is the common goal in real estate.

Real Estate Syndication aka RES, is a business option worth investigating if one is interested in real estate investing but unable or unable to handle it all yourself.

2. Why do people participate in real estate syndication?

Access to deal flow is the main motivation for investors to engage in RES or crowdfunding for real estate. Not every investor has the time to look through hundreds of homes and conduct thorough inspections in search of a hidden treasure. However, there are several real estate firms around the US who make a fortune doing this. Investors can take advantage of this deal flow and the opportunity to invest in real estate without the headaches of property management by participating in real estate syndication.

3. Real estate syndication involves who all?

The sponsor and the investors are the two primary parties in real estate syndication.

The person or business that chooses, organizes, and manages the investment is the sponsor, also referred to as the general partner. The sponsor plans for the acquisition of the real estate asset, employs workers and contractors, monitors development, and takes financial decisions for the project. Additionally, the sponsor is in charge of allocating any earnings or profits from the agreement to the appropriate parties.

Limited partners are the investors in a syndicated real estate deal who play a passive role in the investment. In essence, the investors often provide the majority of the funding needed for the purchase. The sponsor will frequently contribute their own funds and secure loans to fund a sizable chunk, with the remaining capital coming from approved investors.

A third party is frequently involved in modern RES: the crowdfunding platform. Many sponsors decide to post their investment chances on crowdfunding platforms because it’s now simpler than ever to entice investments from the general public (CrowdStreet is one popular example). The platform serves as a go-between for sponsors and investors, charging a charge for capital raising and handling regulatory obligations.

4. Working: Real Estate Syndication.

Let’s start by discussing the fundamentals of real estate syndications. When numerous investors pool their funds to jointly purchase a big piece of real estate, this is known as a real estate syndication. Investment opportunities in a range of real estate assets, such as apartments, mobile home parks, land, self-storage facilities, and other real estate assets, are provided via real estate syndications.

5. Real Estate Syndication: 3 Advantages & Disadvantages

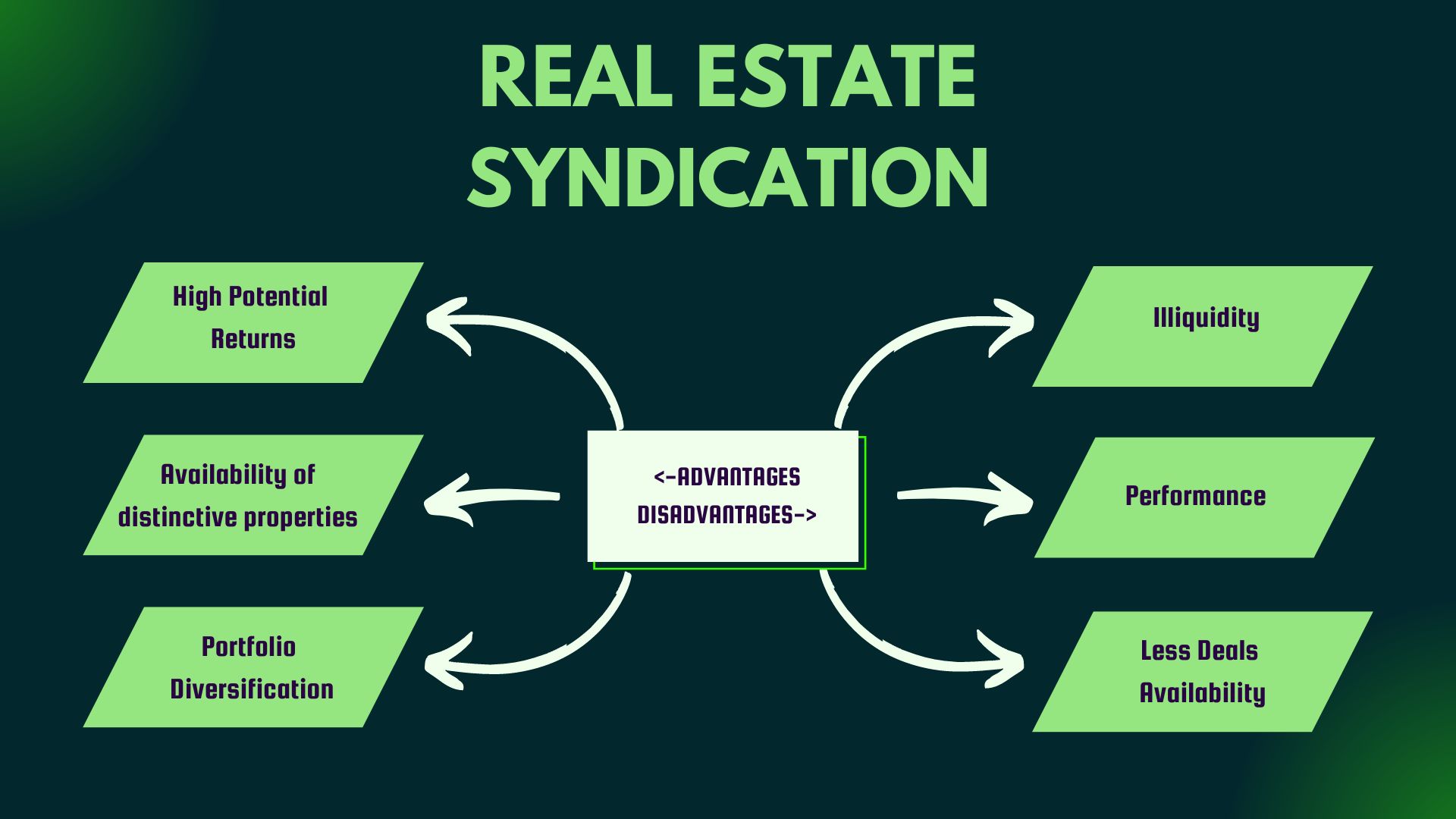

Real estate syndication investments have a number of advantages. Some of them are as follows:

- High potential returns: This may be the main benefit of investing in syndicated real estate agreements. Successful commercial real estate investments can bring in a sizable profit. All of the realized (sold) properties that have obtained finance using CrowdStreet’s platform are kept on file. Investors have received an average internal rate of return (IRR) of 17.7% on 115 realized investments, a fantastic annualized return record.

- Availability of distinctive real estate investments: As said earlier, the majority of individuals couldn’t just pay for the development of a hotel. Furthermore, even if you had the money, would you truly know what to do? Investors with limited experience in real estate development or management can take advantage of new investment opportunities thanks to real estate syndication.

- Portfolio diversification: In volatile markets and challenging economic times, this can be especially advantageous. Investing in real estate syndication can add a great element of diversification to an investment strategy because single-asset real estate returns aren’t closely associated with the stock market and their prices don’t change frequently like stocks.

3 Disadvantages of RES.

- Illiquidity: It’s possible that syndicated real estate investments are the least liquid type of real estate investment. You can easily sell your shares of a real estate investment trust (REIT) whenever you choose. You can decide to sell your investment property even if it might take a few weeks or months. Typically, the whole holding period of a syndicated real estate sale is illiquid.

- Performance is connected to one asset only: The fact that the corporation has a variety of properties is one of the benefits of investing in REITs. Even if one of them did poorly, it wouldn’t really matter. Your money is often tied to one asset in syndicated arrangements, which can lead to significant losses if it performs below expectations.

- Deals don’t always pan out: Syndicated real estate investments can generate outstanding returns, as demonstrated by the 17.7% annualized average return on one well-known platform, which was discussed in the pros section. There is, nevertheless, a wide variety of potential outcomes. In actuality, out of the 115 realized investments, five generated annualized returns of greater than 50%, while six of the agreements saw investors’ money lose completely. The risk/reward ratio can still be very compelling, but it’s important to keep this in mind if you’re only participating in one syndicated real estate project.

After reading about RES, think seriously to go for it.