Why Pricing Your Rental Over Market Value Works Against You: Insights from Property Management in Las Vegas

Are you a landlord in Las Vegas looking to maximize your rental income? It’s tempting to set the rent price higher than the market average, hoping to squeeze out more profit. However, this strategy often backfires and can lead to prolonged vacancies, increased turnover, and ultimately, decreased profitability.

As experts in property management in Las Vegas, Triumph Property Management understands the importance of pricing rental homes appropriately. Let’s delve into why pricing your rental over market value can work against you.

Limited Tenant Pool

Setting the rent above market value drastically narrows down your potential tenant pool. In Las Vegas, where rental homes are abundant, tenants have numerous options to choose from. If your property is priced too high, prospective tenants are likely to explore other listings that offer better value for their money.

Extended Vacancies

High rental prices often lead to longer vacancy periods. Every day your property sits vacant, you’re losing potential rental income. Additionally, prolonged vacancies can raise concerns among prospective tenants about the property’s desirability or condition, further exacerbating the issue.

Increased Turnover

Tenants who feel they’re paying more than what the property is worth are more likely to seek alternative housing once their lease ends. High turnover rates not only result in additional costs associated with finding new tenants but also contribute to the wear and tear of your property, reducing its long-term value.

Negative Reviews and Reputation Damage

In today’s digital age, tenants are quick to share their rental experiences online. Overpricing your rental could result in negative reviews, damaging your reputation as a landlord or property management company. Negative feedback can deter prospective tenants from considering your property, making it even harder to fill vacancies in the future.

Legal Risks

Pricing your rental significantly above market value may attract legal scrutiny. In some jurisdictions, landlords are required to justify their rental rates, and charging excessive rents could potentially lead to legal disputes or even accusations of discrimination.

So, What’s The Solution?

Triumph Property Management recommends conducting thorough market research to determine the optimal rent price for your property. Consider factors such as location, amenities, and current market trends.

Additionally, leverage the expertise of a professional property management company like ours, specializing in rental homes in Las Vegas. Our team can provide valuable insights into local rental market dynamics and help you set competitive yet profitable rent prices.

Here are Some Additional Points to Consider:

Decline in Tenant Quality

It’s a game of numbers. When a property is priced above market, it attracts fewer prospects, leading to a diminished pool of potential tenants. This scarcity often forces owners to compromise on their standards, such as allowing pets, smokers, or tenants with subpar credit scores. Conversely, when there’s a broader selection of prospective tenants, property managers have the luxury of handpicking high-quality tenants.

Search Engine Visibility

Search engines prioritize rental listings based on factors like price, bedrooms, bathrooms, and location. Therefore, if your property is priced too high, it might not even appear in the search results unless there’s a severe shortage of options in that particular area. The likelihood of being the sole available property for rent in a specific school district is extremely slim.

Time is Money

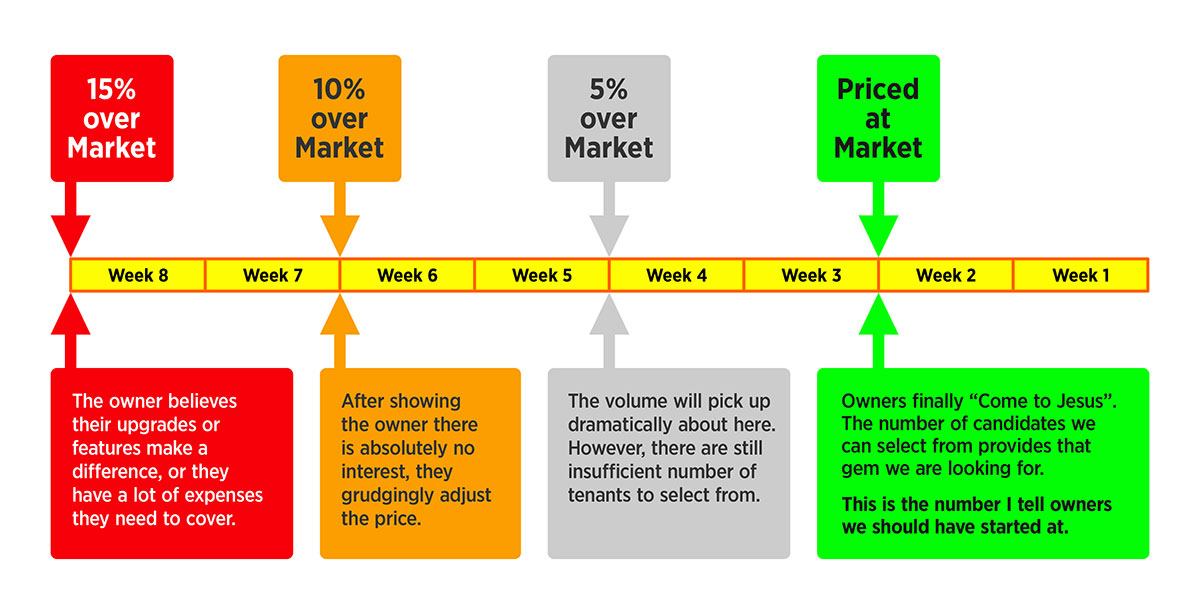

Overpricing a rental property leads to reduced interest from potential tenants, ultimately prolonging the vacancy period. Every day the property remains unoccupied translates to lost income. The longer a property remains overpriced, the more it costs the owner in terms of lost rental income. In fact, statistics suggest that a property listed 5% above market value takes approximately four weeks longer to secure a tenant.

High Turnover Rate

Tenants willing to pay above-market rent often hail from regions with exorbitant rental rates, such as California. However, once they realize they’re paying more than the market average, they’re likely to seek alternative accommodations before their lease expires. This frequent turnover not only results in extended vacancy periods but also adds to the hassle and cost of finding new tenants. On the other hand, tenants paying market or slightly below-market rent are more inclined to stay longer, reducing turnover costs and headaches for property owners.

Vandalism Risks

Vacant properties are prime targets for vandalism, attracting unwanted attention from individuals seeking opportunities for mischief. Signs of prolonged vacancy can entice vandals, leading to costly damages such as broken windows, doors, or stolen appliances. Moreover, the mental stress associated with owning a vacant property can further compound the issue. Shockingly, statistics reveal that approximately 25% of properties vacant for over 30 days fall victim to vandalism.

By avoiding the pitfall of pricing rental properties above market value, property owners can attract better-quality tenants, reduce vacancy periods, minimize turnover costs, and mitigate the risk of vandalism. It’s evident that aligning rental prices with market rates not only benefits property owners financially but also contributes to a more stable and secure rental experience for both landlords and tenants.

In conclusion, while it may be tempting to inflate your rental prices, doing so can have detrimental effects on your profitability and reputation as a landlord. By pricing your rental property at or slightly below market value, you’ll attract more qualified tenants, minimize vacancies, and ultimately maximize your long-term returns.

For expert assistance with property management in Las Vegas and optimizing your rental pricing strategy, contact Triumph Property Management today, 702-799-9999. Don’t let overpricing work against you – let us help you achieve success in the Las Vegas rental market!