Property managers play a huge role in handling the finances related to properties and housing. As such, it’s worth investing in accounting solutions to streamline the property management process. According to Verified Market Research, the global property management market was valued at $13.57 billion in 2023. Market researchers expect further growth, reaching $26.48 billion by 2031. Researchers cite the increasing complexity and scale of real estate portfolios worldwide as primary drivers for this market growth.

As the market continues to grow, it’s important for property managers to improve their offerings and processes to stand out in the competitive market. Fortunately, technological advancements in property management software and analytics are enhancing operational efficiency while positively impacting tenant satisfaction. At the same time, demographic trends such as the rise of millennials and Generation Z entering the rental and housing market are contributing to the rising demand for properties.

As mentioned above, accounting is one of the most important elements of property management. Below, we’ll take a closer look at the importance of accounting for property managers, how accounting software can help property managers, and other tips for making bookkeeping easier for property managers:

The Importance of Accounting for Property Managers

Accounting in property management focuses on the various financial tasks and processes related to rental properties, whether residential, commercial, or mixed-use. With proper accounting, property managers can keep accurate records of income and expenses and improve budgets to ensure that funds are allocated appropriately for other aspects of property management, including maintenance, repairs, and other expenses.

Some of the key aspects of accounting for property managers include rent collection and tracking, financial reporting, tax compliance, lease and contract management, as well as handling tenant security deposits. Similarly, proper accounting also helps property managers ensure compliance with local, state, and federal regulations for matters like financial reporting and tenant management.

Using Accounting Software to Streamline The Process

As previously mentioned, digital innovations in the market have helped make the property management accounting process more streamlined and refined. For the sole purpose of accounting, using revenue recognition software can help make the process easier and more accurate.

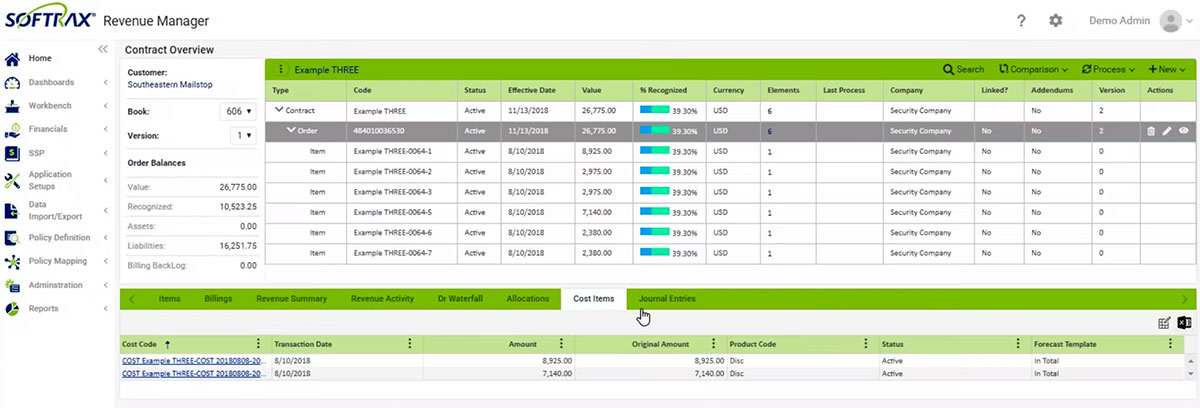

Softrax demonstrates how this software is automated and cloud-based, eliminating the need for complex spreadsheets and manual workarounds. This helps reduce human errors and automates the most complex revenue management processes. Revenue recognition software can also help ensure compliance with requirements like ASC 606 and IFRS 15.

Softrax Revenue Recognition Software Screenshot

At the same time, there are other kinds of accounting software that property managers can use. Most modern property management software can also help with finances and accounting. According to a report from Allied Market Research, the property management software market is estimated to reach $7.8 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033. Most modern software is adopting cloud computing solutions and software-as-a-service as a system.

These types of software help track and organize property-related information and manage tasks related to property management. This includes approving lease applications, resolving maintenance issues, and handling payments.

Keeping Collections Current

While software can certainly help, it’s still important for a property manager to be in control of finances. One of the most important aspects is to keep collections current. While there may be unexpected situations where you may have to waive fees, it’s also important not to let late collections pile up, as this may hurt your finances in the long run. If you do have to waive fees, it’s important to record them and categorize them by units or properties accordingly. It’s also important that you maintain a consistent process according to your local and state guidelines.

Some types of software can help automate rent collection, ensuring that tenants pay rent automatically. Meanwhile, some property managers may prefer other methods for ensuring collections remain prompt, and tenants are kept accountable. You can do this by having an established collection schedule among tenants, along with reminders for deadlines, predetermined late fees, and notices for eviction. Having a consistent and planned schedule can help maintain your collections.

Keeping an Emergency Fund

Another essential element that software can’t automate for you is to keep an emergency fund or “rainy day” fund for your expenses. Property management can involve various unexpected costs depending on the situation. This includes repairs, maintenance, vacancies, or emergencies. If you don’t maintain an emergency fund for these unexpected situations, your cash flow, profitability, and even reputation as a property manager can be impacted.

Just as you would establish a system for keeping your collections current and prompt, it’s important to plan ahead. Adhering to and adjusting your budgets as a property manager can help you foresee unexpected costs or expenses. Your budget should also include an emergency or contingency fund, just in case. Another surefire way to avoid unexpected costs is by closely monitoring your properties and performing preventive maintenance instead of waiting for things to get worse and amount to higher costs.

Modernizing Payment Practices

Finally, another tip for making property management accounting easier and more manageable for you is to modernize payment practices. According to this article from PYMNTS, more than 34% of Americans rent their homes, representing billions of dollars in monthly rental payments to landlords and property managers. Still, some landlords and property managers still rely on outdated or inefficient payment methods such as paper checks, wire transfers, and other systems, which can lead to errors or delays in payments.

Over the years, renters have shown a higher preference for digital payments due to the instant transaction and added convenience. Survey results show that more than half of renters pay their rent online, with 77% citing greater ease and speed than traditional methods as primary reasons for doing so. Renters who pay online also tend to be more satisfied with their property and property management than those who don’t. As such, adopting more modern payment practices can help optimize your accounting process while appealing to shifting renter and tenant trends.

If you found this post useful or insightful, you can check out our recent post on decreased mortgage rates in Las Vegas and Reno, Nevada, where we also highlighted some key bad business practices associated with the big housing crash of 2008-2009.

Article contributed by Rhea Jeanette